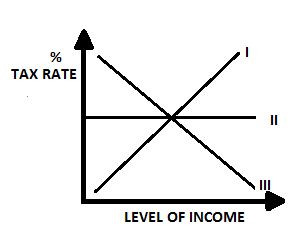

A. regressive tax

B. progressive tax

C. value added tax

D. proportional tax

Correct Answer:

Option A – regressive tax

Explanation

A regressive tax falls as incomes increases while progressive tax rises as income increases. Proportional tax is a flat rate while value added tax is the tax imposed on goods and services at each stage of production.